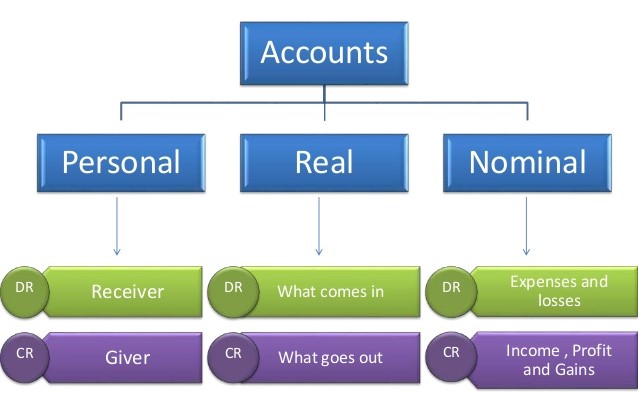

Each account in chart of accounts is classified based as one of the type of the accounts. To understand the transactions and financial reports these different account types should be understood.

1. Personal Accounts :

These are accounts that are related to individuals, firms, companies etc. Mostly on the names of the persons or the companies.

- Natural Personal account : It is an account where the transactions within the individual persons regarding personal transactions.

- Artificial Personal account : An account that is regarding an artificial person where it takes care of the whole transactions on that name such as institutions or college accounts or pvt.ltd companies.

- Representative Personal account : An account which is directly or indirectly representing a person or persons such as salaries account.

- The golden rule of personal accounts

- Debit is the receiver.

- Credit is the Giver.

2. Real Accounts :

It deals with the accounts of a firm where all the assets which are tangible or intangible fall under Real accounts.

- Things that can be felt and touched physically are tangible such as buildings, machinery, stock etc comes under Tangible real accounts.

- Things that can't be touched and felt physically are intangible such as licenses, patents etc comes under Intangible real accounts.

- The golden rule of Real accounts

- Debits is what comes in.

- Credit is what goes out.

3. Nominal Accounts :

The accounts which are related to expenses, losses, incomes or gains comes under Nominal accounts.

- The nominal itself means existing in name only.

- Nominal accounts don't really exist in physical form but behind every nominal account money is involved.

- The golden rule of Nominal accounts.

- Debit all expenses and losses.

- Credit all incomes and gains.

Accounting Terminology

1. Assets :

They are the items that company owns such as land, inventory, vehicles, money etc.

- The assets are grouped according to each other based on their life span

- The items that are completely sold within or less than 12 months and converted into cash is known as Current assets.

- The items that are last more than one year or even longer is known as Fixed assets such as buildings, machinery, vehicles etc.

2. Liabilities :

They are the debts or financial commitments of a company which owes to others. Liabilities are mainly the money that has to be paid.

- Current liabilities are which they are paid in less than 12 months or on a monthly basis such as short term loan sales tax, income tax etc.

- Long- term liabilities are typically paid off in years instead of in months of span. It can be based on the bonds.

- Liabilities are the negative value that are to be cleared.

3. Equity :

It is a portion of the total assets that the owner owns it completely.

- It may be in assets or buildings or cash which is completely owned. Primarily referred to as Net worth.

- The relation between the assets, liabilities and equity is shown in the figure.

4. Income (or) Revenue :

Income is the money that the company earn by selling the product, other names of income or revenue, gross income or turnover.

- Net income is revenue less expenses other name for net income is profit.

- Accrual basis account counts the revenue as soon as the invoice is entered into the accounting system.

- Cash basis accounting doesn't count the revenue until the invoice is paid.

5. Expenses :

Expenses are the expenditures that a company operate most often on monthly basis such as rent, supplies, travel etc.

- Like the revenue accounts, expenses account are temporary accounts that collect data for only one accounting period.

0 comments:

Post a Comment